|

| ‘Wake me up when September ends’. |

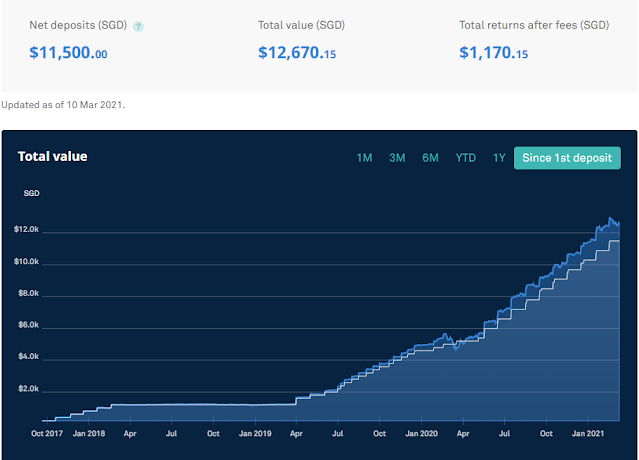

We are into the last quarter of 2020. And what better time than to review the dividend earnings. Despite the volatility and fear in the market now, we have continued with our DCA tactic and adding to our positions through our Share Builder Account and StashAway. The exposure to US markets through StashAway has been good and we intend to rebalance our portfolio slightly at the end of the year or the coming year to factor in for more growth potential.

Thus far, we have received around $850 in dividends with three months more in 2020. The projected dividends that we will be receiving has since been revised up to $1100 from $700 as we have continued increasing our portfolio size.

This year really has been eventful, in both the good and bad sense. Covid-19 has put forward a new normal in our daily lives. I hope everyone is adjusting well and staying safe!

I use Stocks.Cafe to track my dividends and portfolio. If any of you are interested to try it out, you can check out my link here!

Share with me your thoughts and comments on having a dividend income stream!

SG FI Dad, out.