Wow, it is already May!? Been seeing a lot of 'Sell in May and go away' memes recently. How much truth is there in these, I am not so sure, you tell me! Nevertheless, April was eventful and there is a lot to be thankful for. Even though COVID-19 seems to be flashing its fangs again with some 'active clusters' appearing, I am hopeful that we can overcome this eventually. Just grateful that everyone at home is safe and sound. Hopefully, you guys have been doing well too and staying safe!

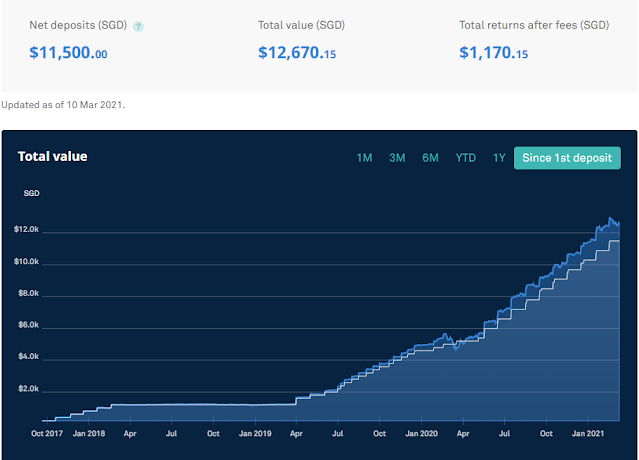

We have diligently continued our DCA strategy with StashAway as it continues to provide us with better returns than just parking this money in our savings account. We have also been DIY on some US ETFs and counters but I will update that in another post some other time. StashAway continues to have decent returns for us albeit unrealised as we have not cashed out anything.

On a separate note, I have started a YouTube Channel showcasing my hobbies. If you are interested, you can watch my latest video here! Any feedback, subscriptions or comments is deeply appreciated!

My YouTube Channel: LINK HERE!

My Instagram: LINK HERE!

Check out my other stuff: LINK HERE!

SG FI Dad, out.